Top 5 Ways to Find Your Vet Practice's Worth

- Aug 28, 2025

- 4 min read

Updated: Sep 5, 2025

When considering veterinary practice ownership changes, you naturally want to know, "What is my vet practice worth? How do I determine its value and appropriate selling price?" A practice valuation will answer these questions for you – and provide other insights you'll need to sell your practice.

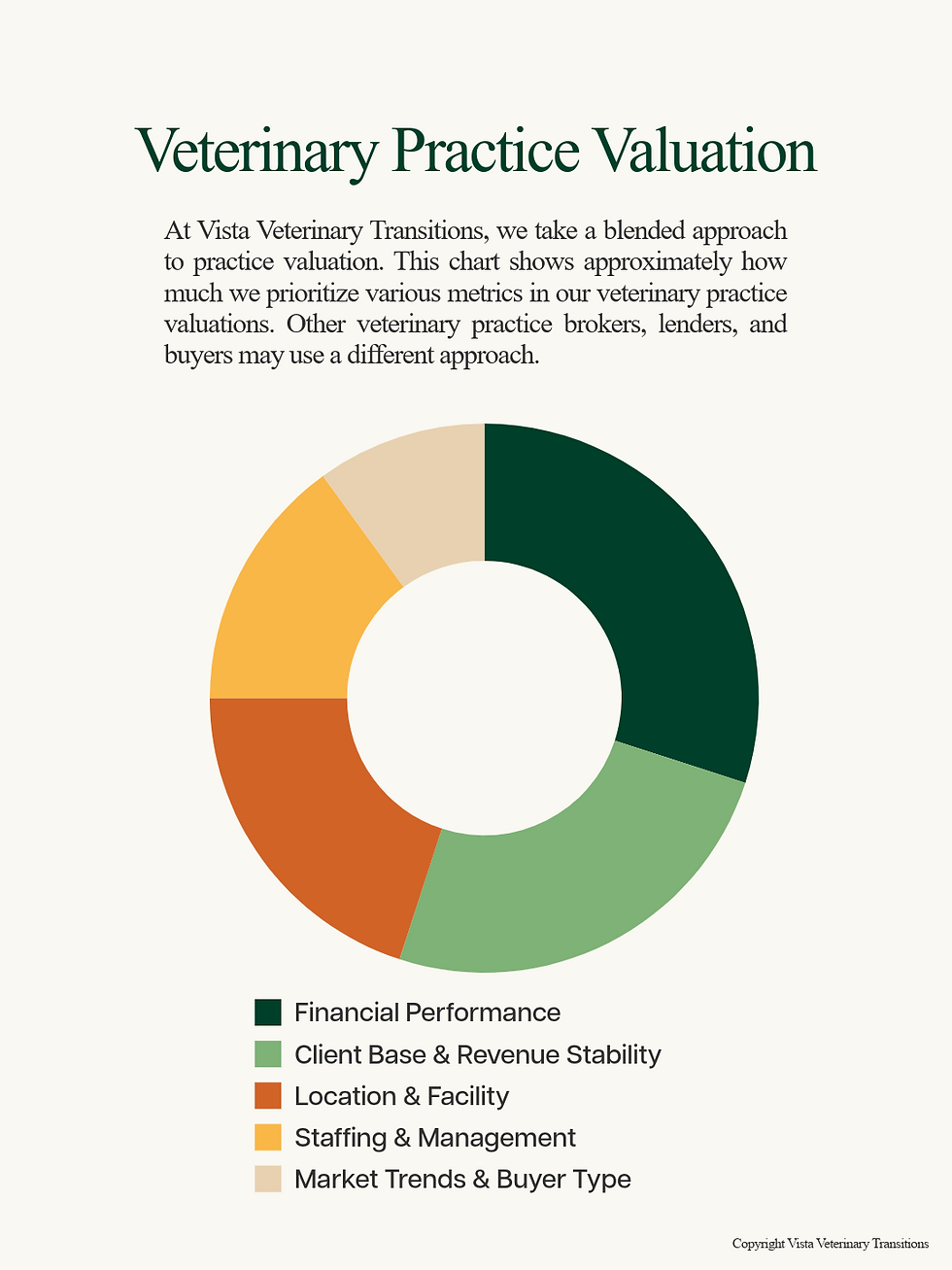

A properly documented practice valuation provides you with stronger bargaining power when dealing with buyers. Practice valuation can vary between veterinary practice brokers and practice lenders. However, certain factors are common to all approaches. At Vista Veterinary Transitions, we combine multiple valuation methods in a blended approach. We consider these elements:

Financial Performance

Financial Performance plays the most critical role in establishing the worth of your veterinary practice. The answer to "What is my Vet Practice Worth?" depends most heavily on its past financial performance, as well as its expected future results. The broker uses past financial statements from the last three years – including income statements and tax returns – to start their analysis. The valuation process places its highest importance on the current year's financial data and the previous year's results. Key metrics include:

Gross Revenue: The practice valuation begins with the evaluation of its total annual gross revenue, which establishes the value base. Veterinary practices with smaller- to medium-size operations usually sell their practices based on a percentage of their annual gross revenue.

Profitability: To get a better picture of your practice's value, we'll determine your seller’s discretionary earnings (SDE) and earnings before interest, taxes, depreciation, and amortization (EBITDA). These profit-based figures present a better representation of your practice's profitability than the gross revenue does.

What is SDE? The calculation of SDE includes net income, owner compensation, interest payments, taxes, depreciation expenses, and personal/non-recurring expenses. SDE is critical to the value of small- and medium-sized practices, which often have a practicing owner and less than 1 million dollars in annual collections.

What is EBITDA? This figure encompasses earnings before interest, taxes, depreciation, and amortization costs. EBITDA is a primary factor in the determining the value of larger practices exceeding 1 million dollars in annual collections. Corporate buying groups typically use EBITDA to evaluate practices.

After determining SDE or EBITDA, brokers apply market-based multiples, which stem from past practice sale data and industry market information. The selling price for a solo-practitioner veterinary clinic ranges between 2.5 and 4 times its EBITDA, while multi-doctor practices that demonstrate high growth potential can achieve even higher multiples.

Client Base & Revenue Stability

Your client base & revenue stability are key to predicting your veterinary practice's future financial performance, making them key factors in determining your practice's worth. The team at Vista evaluates your practice's active client numbers, client retention metrics, average transaction charges, and visit frequency. A practice which maintains loyal clients while generating additional revenue through wellness plans, boarding services, grooming, and retail activities will have a higher market value. Revenue concentration is also important. Practices which rely too heavily on a couple of major clients, such as breeders and shelters, may present higher investment risks to potential buyers.

Location and Facility

There's a reason realtors always say, "Location, Location, Location." Practices located in areas with growing urban or suburban populations receive higher offer prices because of strong client interest and minimal market competition. The sales duration for rural practices is usually longer, while their purchase prices remain lower – unless the practice demonstrates strong profitability and owner compensation. A practice located in a more remote area may still attract a suitable buyer because the buyer needs to allocate less budget to marketing efforts. Rural practices have less competition and generally feature lower costs of living and employee wages.

Location assessment includes facility ownership status and leasing terms, measurements, structural elements, equipment status, and interior organization. A practice with clean, well-designed facilities and modern medical technologies – like digital records systems and state-of-the-art diagnostics equipment – will have a higher value. The ownership of real estate might be a separate agreement from the practice value, but it improves the total worth of your practice.

Staffing and Management

Any thorough answer to "What is my vet practice worth?" factors in your practice's staffing and management practices. Buyers, brokers, and lenders will assess your staff composition, payment structures, and employee turnover patterns in their evaluation processes. The operational strength of a practice becomes evident when it maintains stable staff retention, particularly among licensed technicians. It's hard to put a price tag on competent management practices, but they play a role your practice's overall worth. Buyers want the transition process to be as smooth as possible. A well-managed, turnkey practice has more buyer appeal, giving it a higher overall value.

Market Trends and Buyer Type

Purchasing activity in the veterinary practice market activity is split between individual buyers and corporate consolidators. These two buyer types look for very different things when buying a practice. The purchase prices offered by corporate buyers reach their highest levels for practices which deliver strong results within important market locations. Their assessment process is more complex because they prefer businesses with multiple doctors that generate more than $1 million annually in revenue. The value of your veterinary practice depends on market demand, together with interest rates and competitive forces within your geographic area. Although the veterinary practice market experiences overall trends, there can also be trends specific to each buyer type. A broker who understands these market forces will help you achieve the highest possible value for your practice during transition.

In short, the value of your veterinary practice emerges from its financial status, client base and revenue stability, location and facility, staffing, and market trends. A good practice broker will evaluate your vet practice to generate a defensible market-based valuation that helps you create strategic plans for your transition.

Ready for your official veterinary practice valuation? Contact Vista Vet Transitions today!

Comments